We, intelligent real estate investors, know you don’t have to be sitting on a lump sum of capital to finance an investment property. Instead, we tap into alternative real estate financing options, including FHA loans.

An FHA loan, insured by the Federal Housing Administration, is ideal for real estate investors who can’t make large down payments or have low credit scores. It’s primarily intended for residential properties. So the investor must live in the property for one year before renting it out.

Are you a new investor?

I help new and small investors invest in real estate in the US by offering critical thinking to fundamental real estate investing. Based on my investing experience, I created a never seen real estate investing strategy that helps new investors build their first level of financial freedom in three moves.

So if you’re looking to make a passive income stream through real estate, you’re in the right place!

In this guide, I’ll show you how to finance an investment property with an FHA loan, the guidelines, and everything else you need to know to use an FHA loan for investment properties.

Let’s get to it.

What are FHA loans?

FHA loans are mortgages insured by the Federal Housing Administration (FHA). The FHA insures the loans so that FHA-approved lenders can offer lower down payments, lower closing costs, and lower credit requirements than conventional mortgages.

Since 1934, the Federal Housing Administration, which is part of the Department of Housing and Urban Development (HUD), has provided FHA loans to help more people become homeowners.

The loans benefit buyers who do not qualify for a conventional loan or other financing sources and lack the resources to make a sizeable down payment.

It’s a great choice if you’re a first-time real estate buyer because the FHA loan requirements are not as strict as other loans.

Can FHA loans be used for investment properties?

While FHA loans are only available for residential properties, you can still utilize FHA loans to finance an investment property without violating the loan’s terms. Here’s how: You must live in the property as your primary residence for a minimum of 12 months.

I recommend buying a multiunit property so that you can use just one of the units as your primary residence and rent out the rest. FHA guidelines allow you to buy a multifamily property with up to four units.

Why use FHA?

- Low down payment – just 3.5% of the property’s purchase price.

- It’s available for 1-4 unit properties.

- A minimum credit score of 500.

What are the eligibility requirements for FHA loans on investment properties?

To qualify for an FHA loan, you should:

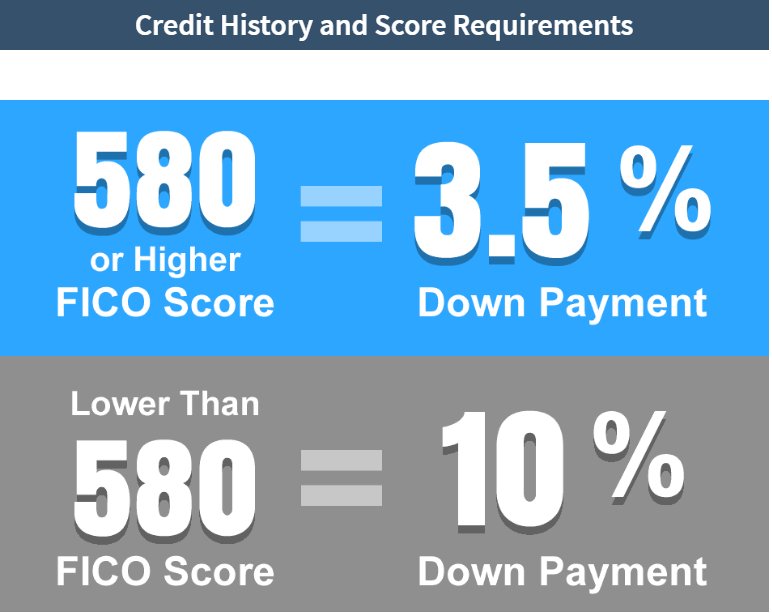

- Have a credit score of 580 (or above) for maximum financing (96.5% of the home’s value).

With a score between 500 and 579, you’re limited to a maximum loan-to-value (LTV) ratio of 90%. So you’ll pay a 10% down payment, while FHA pays 90%.

Loan-to-value (LTV) ratios measure the amount of a loan in relation to the property’s value.

Unfortunately, you’ll be eligible for an FHA loan with less than a 500 credit score.

- Have a minimum down payment of 3.5% of the lesser of the property’s sales price or appraised value for FHA to insure the maximum loan amount.

Note that you cannot use your credit card to make the down payment.

- Have a valid Social Security number (SSN).

- Must live in the property for at least one year before renting it out.

- The property’s price must be within the FHA’s loan limit in its location.

- If you’re not a US citizen, you must have evidence of lawful, permanent residency status (provided by The U.S. Citizenship and Immigration Services (USCIS) within the Department of Homeland Security)

- Non-permanent resident aliens must use the property as their principal residence, have a valid Social Security Number (SSN), and be eligible to work in the United States, as evidenced by an Employment Authorization Document (EAD) issued by the USCIS.

Why would an FHA lender reject your application?

- You are suspended, debarred, or excluded from participating in HUD programs. They found your name on:

- HUD’s Limited Denial of Participation (LDP) list, or

- the US General Services Administration (GSA) List of Parties Excluded from Federal Procurement or Non-procurement Programs, or

- HUD’s Credit Alert Interactive Voice Response System (CAIVRS)

- You’re presently delinquent on a Federal debt

- You have a lien (including taxes) placed against your property for a debt owed to the United States Government.

- You’re a non-U.S. citizen without a lawful residency in the U.S.

In addition to meeting these basic requirements, you should have enough cash reserves to cover any additional costs associated with owning the investment property.

Steps to buying investment properties with an FHA loan

Here are the steps to buying a rental property with an FHA loan:

1. Get pre-approved for the loan by an FHA lender

You can use the HUD Lender List Search page to find an FHA-approved lender.

The FHA does not issue loans. Instead, it insures mortgage loans provided by pre-approved FHA lenders against default. So you have to go through an FHA-approved lender.

By getting pre-approved, you’ll know what type of FHA loan you can apply for, how much you can borrow, and on what terms.

2. Research the real estate market (in your target location)

A four-unit multifamily property might be the best since you can live in one unit and rent out the others from the get-go. But you still need to compare prices of similar properties to pick the best rental property.

Since you intend to rent it out, please choose a location that’s desirable to the person who will rent it.

For example, if you’re targeting seasonal rentals, you want a house close to amenities like resorts, beaches, and the like. And if you’re targeting all-year-round tenants, you want a location where renting is more affordable than buying a house.

Besides looking at how much the property will increase in value over time, there are also market factors to consider.

For example, you want an area where the population will increase and has more employment opportunities and rental rates that justify the investment.

Additionally, all-year-round rentals should be close to amenities like schools, libraries, shops, parks, restaurants, medical facilities, grocery stores, and playgrounds are more desirable.

Still undecided about the right property?

Contact me if you need help or coaching to pick the right investment property. I’ve gone beyond the 7-figure club through real estate investing, and so can you!

3. Get an FHA home inspection

Once you have an ideal home, look for an FHA inspector on the HUD’s Inspectors Page. You’ll pay for the inspection out of your pocket. Depending on the property and location, it could cost around $300 to $600.

An FHA inspector will help you identify issues with the home’s foundation, HVAC, electrical, roof, plumbing, and other aspects. If there are any problems, they’ll need repairs which you should factor into your acquisition cost.

The FHA inspector will also ensure that the property meets FHA’s minimum property standards. And they can also verify the true market value of the home. So they do operate in the capacity of an appraiser.

4. Determine the home’s acquisition and ongoing costs, then move-in

Calculate how much money you need upfront, including the down payment, closing costs (2 to 5% of the loan amount), and repair costs. You also need to consider your mortgage insurance premium, monthly payments, interest, and property taxes.

Work with your FHA lender to complete the loan process promptly.

Once you have everything ready, move into your new property.

While you live in the property for 12 months, prepare for the next purchase.

Your second FHA-financed rental property must meet one of two guidelines:

- The second property must be an upgrade to the first home.

- It must be at least 100 miles away from the first one.

5. Get pre-approved for your second investment property

Since you already have a mortgage, you’ll need to factor in your debt-to-income (DTI) ratio to qualify for the second FHA loan.

The debt to income ratio (DTI) is the percentage obtained by dividing your proposed mortgage payment + total monthly obligations by your gross monthly income.

The FHA guidelines require a 43% DTI ratio or less, but in some cases, they could allow up to 56.9%.

Once approved, go through the previous steps in buying your second property and move in! Remember that your second property has to be an upgrade to your first home or at least 100 miles away.

If possible, you can also repay your FHA loan early because FHA does not charge prepayment penalties.

FHA refinancing for investment properties

An FHA-to-FHA refinance is possible if your home is your rental property and you no longer live there. As long as the home’s mortgage is FHA-insured, an FHA lender can offer you FHA Streamline Refinance.

Streamline refinance means refinancing a previous FHA mortgage with little credit paperwork and without needing an appraisal. The purpose of the second FHA loan is to lower your interest rate or mortgage payments.

But to be eligible for FHA streamline refinances, you must meet the following requirements:

- The existing mortgage should be an FHA loan.